Be risk-free – comply fully with SDD requirements of SEBI’s PIT regulations!

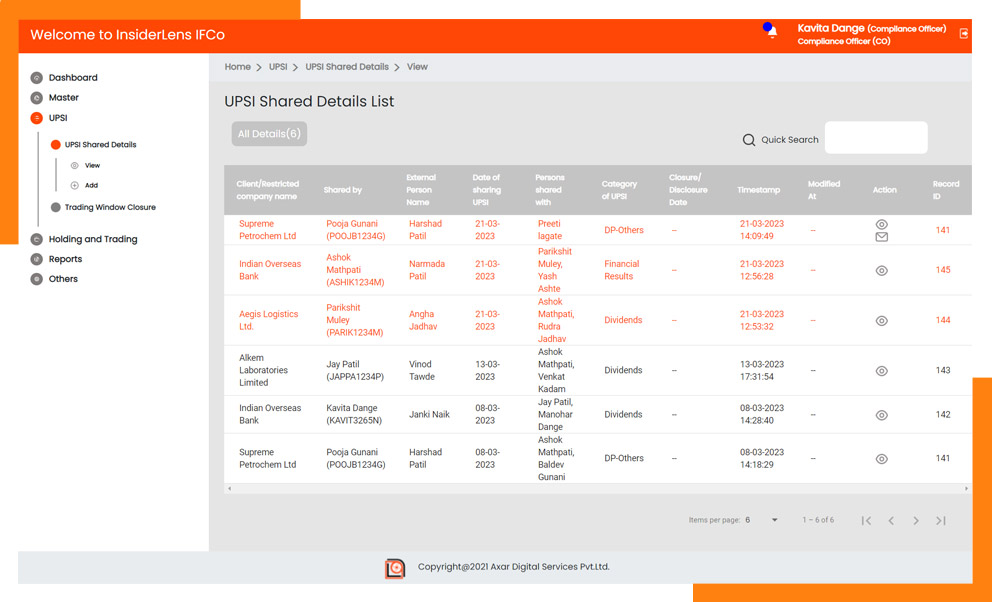

InsiderLens IFCo helps Intermediaries and Fiduciaries meet these compliance requirements, and is up-to-date with all regulatory changes!**

From July 17, 2020, SEBI made the Structured Digital Database (SDD) requirement, under the Prohibition of Insider Trading (PIT) regulations, 2015, mandatorily applicable to Intermediaries (regulated by SEBI, including Banks, Insurance Cos, Brokers, etc) and Fiduciaries (such as Statutory and Secretarial Auditors, Solicitors or Legal advisors, Management Consultants, etc).