InsiderLens LCo

Insider trading compliance solution for Listed entities

Be risk-free - comply fully with SEBI’s PIT regulations!

InsiderLens LCo meets compliance requirements for Listed entities

and is up-to-date with all regulatory changes!**

Experience InsiderLens LCo:

InsiderLens LCo helps mitigate the risk of regulatory action

InsiderLens LCo is a robust, web-based framework that ensures adherence to best compliance and trading practices to help the Compliance Officer, as well as senior management, gain peace of mind, regarding compliance with these regulations.

InsiderLens LCo

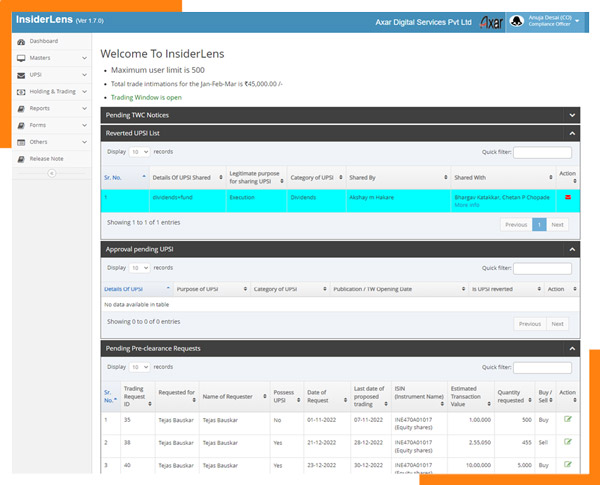

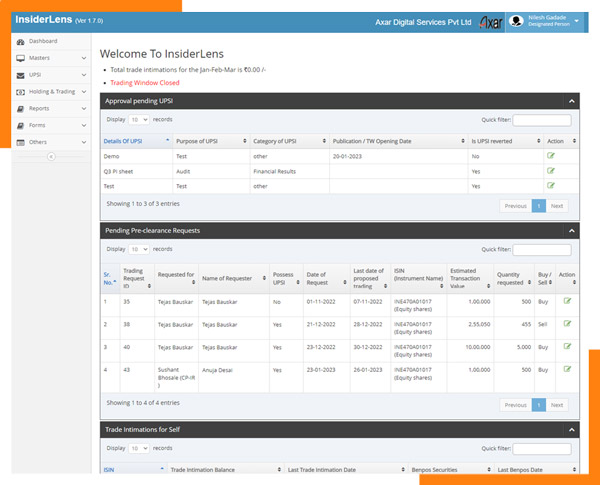

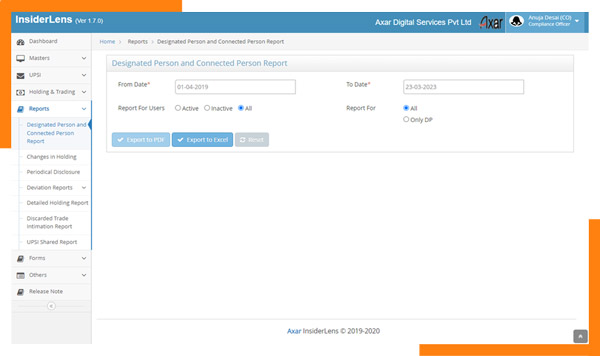

- Window closure alerts to all DPs

- Reconciliation of Beneficiary Positions

- Records DPs declarations

- Reports trades and disclosures

- Cautioning alerts to prevent Insiders from trading in violation of the Regulations.

- Tracks trade activities

- Aauthentication to ensure database security

- Deviation & Compliance Reports

What if you are non-compliant?

regulatory actions.

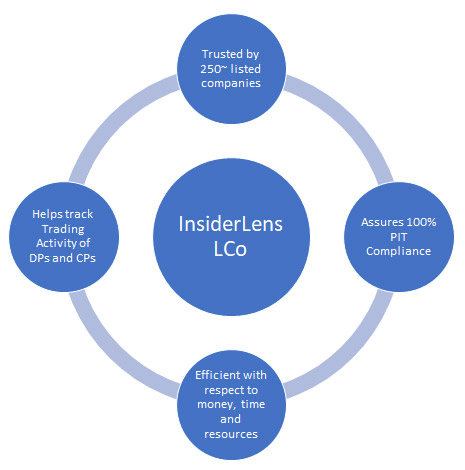

Why InsiderLens LCo?

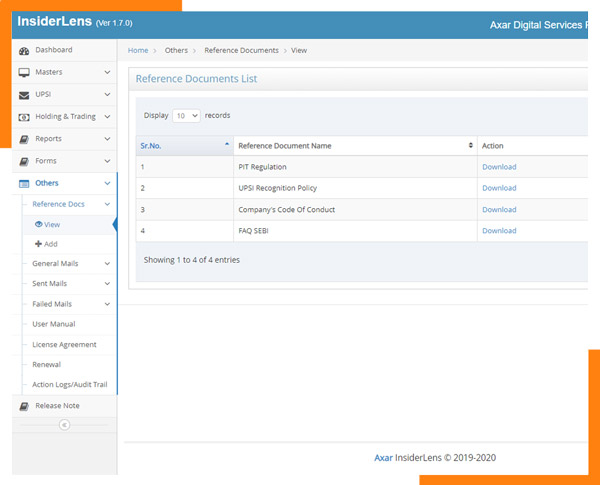

- Complies with SEBI’s guidelines for a Structured Digital Database (SDD) of authorities with private information.

- Certified by an independent PCS firm as compliant with SEBI PIT regulations and up-to-date with amendments.

- Conforms to best trading practices and assures peace of mind in terms of compliance with regulations.

- Provides adequate security controls to ensure the appropriate data handling towards your Regulators and Society efficiently.

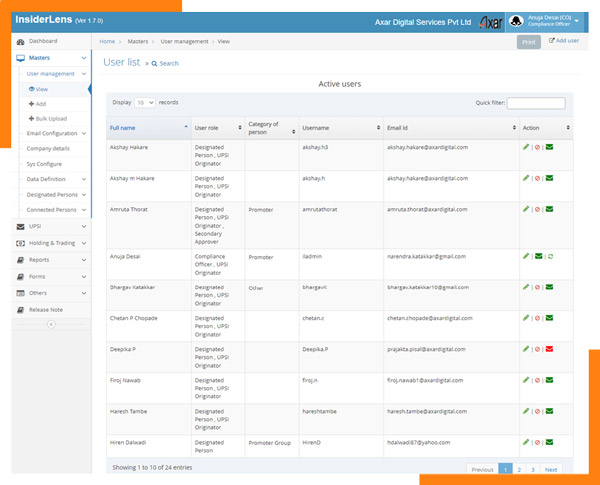

- Offers a higher level of control to the Compliance Officer and the Management.

- Maintains track of any trading activity till the time of public disclosure of the UPSI.

- Notifies of any mismatch in BenPos provided by the RTA.

- Keeps track of every person exposed to UPSI (DP or CP).

- Protects company stakeholders and Compliance Officer from regulatory action for non-compliance and hence mitigates their risk.

- As of April 22, 2023, InsiderLens LCo serves approximately 250 listed entities countrywide.

Axar -Your Partner and Guide in Compliance!

** As certified by an independent PCS firm. Certificate available to clients.

For support

Understanding Regulatory Terminologies

** Source: SEBI (Prohibition of Insider Trading) Regulations, 2015.

Insider: A “designated person”, “connected person” or a person possessing or

having access to Unpublished Price Sensitive Information (UPSI)

Designated Person: One who has been associated with the company in any

capacity such as a director, promoter, officer, or employee or in a contractual or

fiduciary relationship with the company; and includes a list of “deemed designated

persons”.

Connected Person: Any person who is or has been associated with the Company

for six months prior, in any capacity and has direct or indirect access to Unpublished

Price Sensitive Information (UPSI)

Unpublished Price Sensitive Information (UPSI): Any information relating to

securities of a company that is not generally available and, upon being available, is

likely to materially affect the price of the company’s securities. It includes matters

such as financial results, dividends, changes in capital structure, significant

corporate transactions, and changes in key managerial personnel.